The UK government have introduced the Industry Supercharger which aims to make the UK’s largest industrial businesses competitive with the rest of Europe and the World. The Department of Business & Trade and the Department of Energy Security & Net Zero have jointly proposed solutions to improve international competitiveness.

In addition to paying for the commodity (gas/electric) customers also pay for non-commodity costs. The Energy Industry Supercharger looks to reduce these non-commodity costs that Energy Intensive Industries (EIIs) currently pay.

If you are an EII you will already receive exemptions up to 85% from some of your non-commodity costs, including the Renewables Obligation, Feed in Tariff & Contracts for Difference. These are all costs that come from renewable subsidies. The government is now planning to improve the levels of exemption that EII customers are receiving. The current proposals are as follows:

Customers won’t need to reapply for the scheme and DESNZ plan to communicate directly with customers about the changes. If you are unsure whether you are an EII or if you want to know more about how this change could impact your invoice, please reach out to your Client Relationship Manager or Account Manager.

Increasing the Exemption Scheme from 85% to 100% - This relates to extending the exemptions for schemes already included e.g. RO, FITs, CFD. This will be introduced from April 2024

100% exemption from Capacity Market (CM) charges – This is a new scheme which will exempt EIIs from 100% of their CM charges from October 2024.

60% exemption from network charges – This is a new scheme which exempts EII customers from 60% of their TNUoS, DUoS & BSUoS charges. This will be the largest cost saving for EIIs and will be financed by a levy on non-EII customers. This will come in from April 2025 but be paid retrospectively for customers consumption back to April 2024.

Unidentified gas (UiG) has been a longstanding issue within the gas industry and Brook Green is working on a proposal to simplify the process and make payments less volatile for customers. UiG is made up of a number of different components but by far the largest contribution of UiG is theft of gas. All gas consumers across the country pay for UiG, with the Allocation of Unidentified Gas Expert (AUGE) creating an Allocation of Unidentified Gas (AUG) table each year that assigns UiG contributions required based on the meters class and location.

The AUG table is published every October and can create some significant changes year on year for gas customers. We have proposed a change to the industry process through a modification called UNC0831/A. To simplify the process of allocating UiG we have proposed that we end the AUG table and base a customers UiG payment on throughput. This will give customers much more certainty as to what their UiG payment will be every year.

The other part of our proposal is for Class 1 meters to not pay any UiG payment going forwards. Class 1 meters are settled daily, any theft at these sites would be flagged and dealt with immediately and therefore wouldn’t contribute to the overall UiG cost that is calculated every year. On this basis, we believe that Class 1 meters shouldn’t being contributing to the payment of UiG on an annual basis. If this modification is passed, it will be a considerable saving for some customers going forwards. Our original proposal was to include Class 2 meters within the modification but due to constraints with industry systems, we were informed that this change would take longer to implement. Brook Green are still supportive of ending the payment of UiG for Class 2 meters and intend to push this change through industry at a later date.

A decision on our Class 1 modification should be made by Ofgem in the coming months. If approved the modification would be implemented by October 2024 at the latest.

Since the 2008 Climate Change Act the UK government has had a legal obligation to reduce emissions. Initially this was to 80% of 1990 levels but in 2019 this changed to 100% of 1990 levels by 2050, thus creating what is now referred to as Net Zero. The Climate Change Committee (CCC) was setup by the government to monitor the UK’s progress towards 2050 and critique and analyse how decisions will impact the UK’s progress. This is partly done via the CCC’s carbon budgets, which are produced every 6 years. The government made successful progress against the first two carbon budgets that ran from 2008-2014 & 2014-2020 but are currently not on track to meet the requirements set out in the third and fourth carbon budgets running from 2020-2026 & 2026-2032.

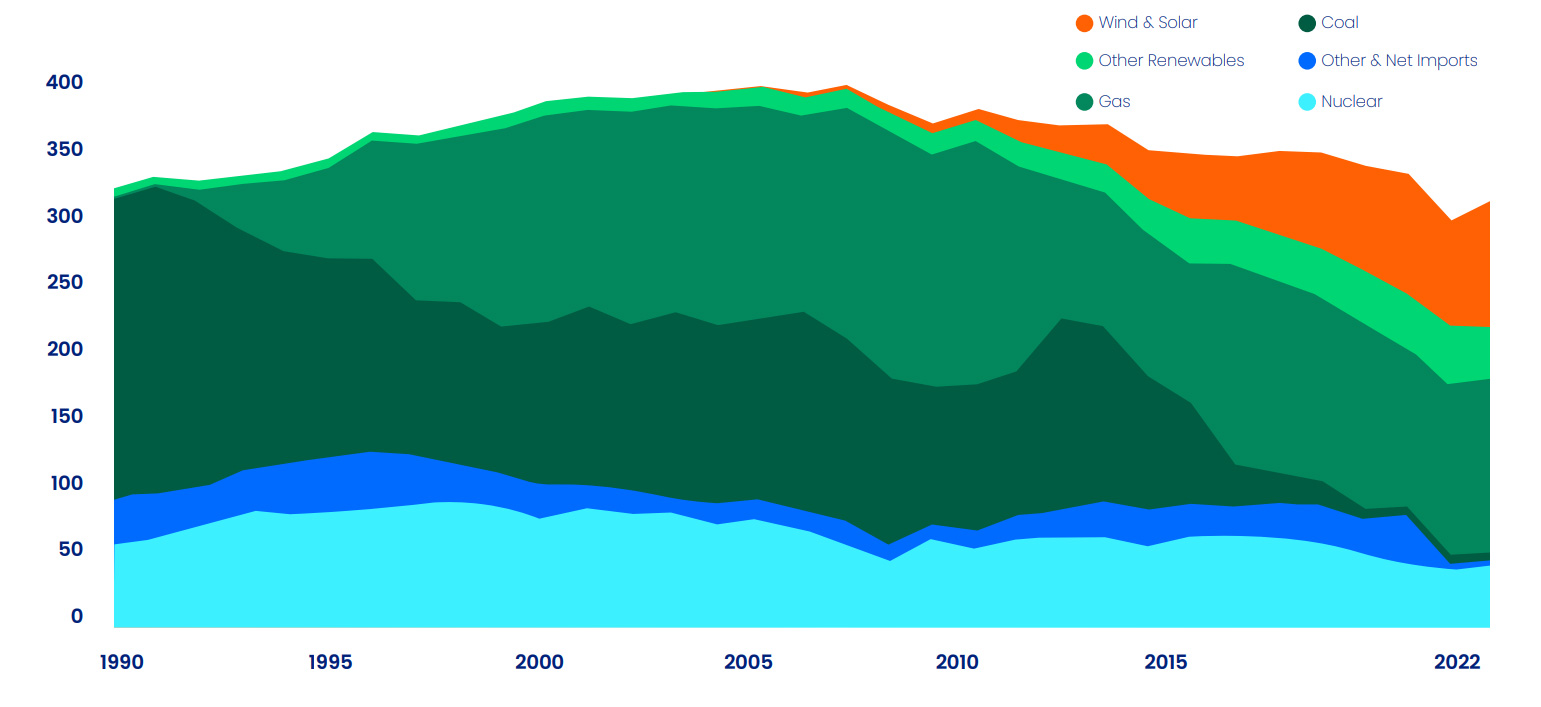

Energy is one of the key industries that needs to decarbonise on the road to Net Zero. Over the past fifteen years we have seen the amount of coal contributing to the UK’s electricity generation mix drop significantly (see graph below) and the amount of renewable energy increase. We expect this trend to continue, with the amount of gas being used for electricity generation decreasing in the coming years. We also except overall electricity consumption to increase, with the country attempting to transition away from gas as we continue to electrify processes and perhaps use hydrogen in some cases.

There has been some quite significant movement on Net Zero policies recently. Prime Minister Rishi Sunak announced changes to the ban on purchasing new petrol and diesel cars by 2030, delaying the ban to 2035. Elsewhere the ban on installing oil boilers for off-gas-grid homes to 2035, instead of phasing them out from 2026. The ban on new gas boilers will also be pushed back from 2030 to 2035. The Labour Party has committed to reversing the EV policy change but not the boiler proposals.

There was also attention given to energy in the Autumn Budget. The biggest news for the energy sector was the proposed reforms to support new electricity generation by speeding up connections, expanding the transmission network and exempting new connections from the Electricity Generator Levy. The government has also frozen the Climate Change Levy (CCL) until 2026 and created a new CCL exemption scheme to run from 2025-2031.

There are a number of types of hydrogen, but the three main ones are Green, Blue and Grey. Green hydrogen is produced through the process of electrolysis, where water is split into hydrogen and oxygen using electricity generated from renewable sources such as wind, solar, or hydropower. This method ensures that the entire production cycle is free from greenhouse gas emissions. Blue Hydrogen is derived from natural gas through a process called steam methane reforming. However, the carbon emissions produced are captured and stored using carbon capture and storage (CCS) technologies. While not entirely carbon-neutral, blue hydrogen represents a transitional step towards cleaner energy alternatives. Grey Hydrogen is the traditional form, primarily produced through steam methane reforming without carbon capture. This method releases carbon dioxide into the atmosphere, contributing to the carbon footprint. It is gradually being phased out as the global focus shifts towards cleaner alternatives.

Hydrogen blending is an innovative strategy that involves integrating hydrogen into existing natural gas pipelines to stimulate economic growth and reduce carbon emissions. This transformative approach considers technical, economic, and regulatory factors, offering two primary methods: volumetric and energy content blending. Blends are categorized as low, medium, or high based on hydrogen concentration, with each blend type requiring different infrastructure adjustments. The goal of hydrogen blending is to capitalize on hydrogen’s clean-burning properties, reducing carbon footprints without extensive infrastructure changes. It aligns with global efforts to achieve a sustainable, low-carbon energy future. However, the National Infrastructure Committee (NIC), who advise the government on key infrastructure projects, have recently recommended that hydrogen will not play a major role in home heating due to the higher costs associated with hydrogen compared to heat pumps. Within the same report, the NIC did state that they believe that hydrogen will have a role to play with the Industrial & Commercial sector as it’s believed that some intensive practices won’t be practical to electrify.

Ensuring the extensive utilization of low-carbon hydrogen throughout the 2020s and 2030s is considered imperative in meeting binding carbon budgets and realizing Net Zero objectives. The Government has set an ambitious target of achieving up to 10GW of low-carbon hydrogen production capacity by 2030. To help achieve this, the Energy Act 2023, has recently received Royal Assent. Aligned with the Government’s Energy Security and Net Zero plans, the Act includes measures which are vital for initiating and advancing the hydrogen economy. Within the Act, two funding options for hydrogen production, transport, and storage business models are delineated: exchequer funding and levy funding. Initially, the Hydrogen Production Business Model (HPBM) will receive exchequer funding, with a planned transition to levy funding at a later stage. The government has yet to make a final decision on the funding approach for the transport and storage business models, but it’s believed that a hydrogen levy passed through to customers on a volumetric basis is likely to be implemented.

The energy transition is no longer just a technical challenge – it’s a political one. While net zero remains the ultimate goal, a more fractious political landscape is turning it into a point of contention and a tool for leverage.

We’re closing in fast on a full year of Labour government, and DESNZ is continuing to escalate its plan to deliver ambitious reforms to our energy system. Delve into our latest Energy Policy & Regulation Report for in-depth analysis on the latest developments shaping the energy landscape.

Watch back to hear a rundown from our experts on Trump's recently introduced tariffs, non-commodity charges, zonal pricing and MHHS programme.