Intelligent energy starts here.

Reading the signals. Connecting the dots. Turning data into supply solutions for a new energy era.

Energy supply

Electricity & gas

From fixed to flexible – and everything in between – our supply contracts give you the confidence, clarity and understanding you need to efficiently manage your energy.

Renewable electricity & gas

Unlock 100% renewable energy for your business, on fixed or flexible contracts. From PPAs to green certificates, we have the right solution to help you start – or accelerate – your sustainability journey.

Generation

Generation export

We work with a broad variety of generators to offtake and manage energy, with customised PPA solutions that combine market insight and operational flexibility to maximise returns.

Solutions

Decarbonisation solutions

Reduce risk and unlock value on your path to decarbonisation with tailored solutions built on analytics, regulatory insight, and flexible design.

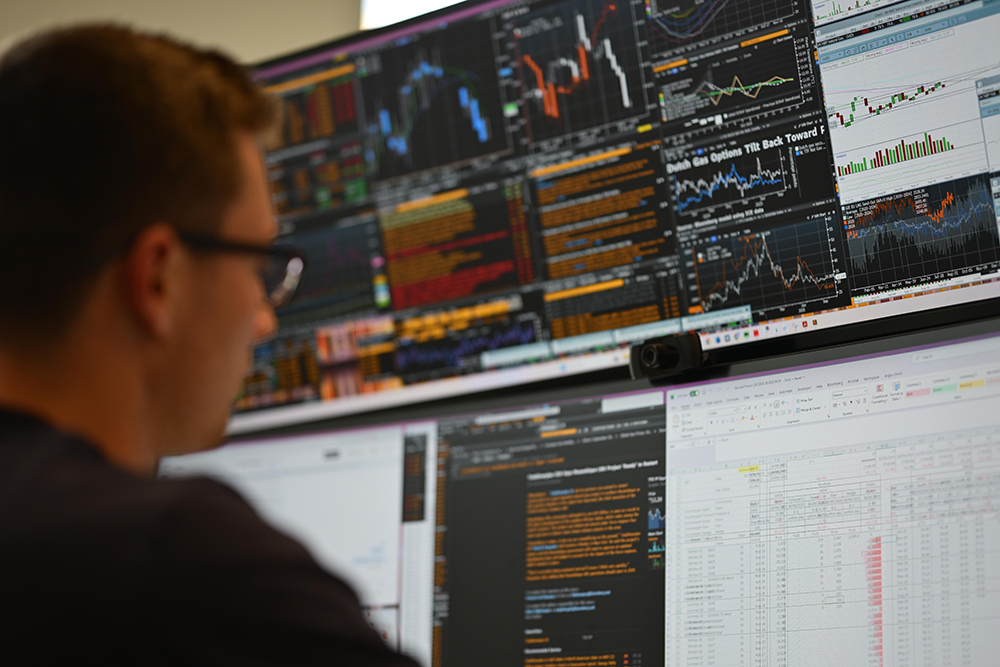

Trading & risk management

We put you close to our traders and analysts to design energy strategies tailored to your needs and objectives. Our team blend fixed and flexible solutions with live market insights, renewable certificates and expert support, to help you trade smarter.

Join our team

Q4 2025:

Energy Policy & Regulation Report

-3.png)

Author

Head of Policy & Regulation

Redefining Scope 2: Inside the GHG Protocol Update

What do the proposed updates to Scope 2 mean for the future of carbon accounting?

Our webinar will provide you with a clear, practical walkthrough of the proposals and their potential impact on your business.

.png)

Insights hub